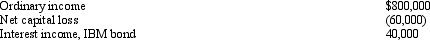

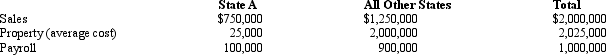

You are completing the State A income tax return for Quaint Company. Quaint is a limited liability company, and it operates in various states, showing the following results.

In A, all interest is treated as business income. A uses a sales-only apportionment factor. Compute Quaint's A taxable income.

In A, all interest is treated as business income. A uses a sales-only apportionment factor. Compute Quaint's A taxable income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: Hermann Corporation is based in State A

Q128: A local business wants your help in

Q137: Compost Corporation has finished its computation of

Q141: Bobby and Sally work for the same

Q142: List which items are included in the

Q149: Your client wants to reduce its overall

Q151: Troy, an S corporation, is subject to

Q152: You attend a tax webinar in which

Q200: Discuss how a multistate business divides up

Q202: The sales/use tax that is employed by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents