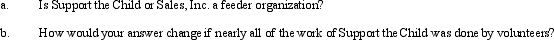

Support the Child, Inc., a § 501(c)(3) organization, provides clothing for the children of disabled, low-income taxpayers. All of the clothes are received as contributions from individuals or from a wholly-owned, for-profit subsidiary (Sales, Inc.), which is in the retail clothing business (i.e., clothing that has been in inventory for over 120 days is transferred to Support the Child for distributions to qualified individuals). In addition to the clothing, Sales distributes 75% of its net income each year to Support the Child.

Correct Answer:

Verified

Q106: What are intermediate sanctions and to what

Q110: What tax forms are used to apply

Q118: Discuss benefits for which an exempt organization

Q123: Which requirements must be satisfied for an

Q132: Is the taxation of a feeder organization

Q133: Are all exempt organizations eligible to be

Q135: Describe how an exempt organization can be

Q137: What income and activities are not subject

Q138: Is there a materiality exception associated with

Q141: If an exempt organization distributes "low-cost items"

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents