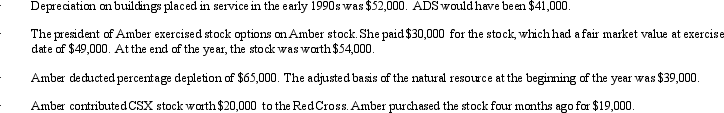

Amber, Inc., has taxable income of $212,000. In addition, Amber accumulates the following information which may affect its AMT.  What is Amber's AMTI?

What is Amber's AMTI?

A) $212,000.

B) $233,000.

C) $238,000.

D) $249,000.

E) None of the above

Correct Answer:

Verified

Q43: To the extent of built-in gain or

Q52: From the perspective of the seller of

Q58: Which of the following is correct regarding

Q58: Mercedes owns a 40% interest in Teal

Q61: Barb and Chuck each have a 50%

Q62: Austin is the sole shareholder of Purple,Inc.Purple's

Q63: Beige, Inc., has 3,000 shares of stock

Q64: Brown, Inc., has accumulated earnings and profits

Q65: Barb and Chuck each own one-half of

Q67: Shania, Taylor, and Kelly form a corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents