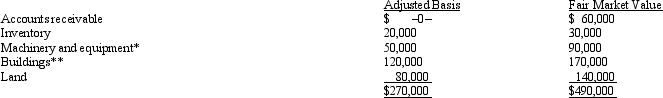

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Q82: Devon owns 40% of the Agate Company

Q83: Match the following statements: Q84: Mr. and Ms. Smith's partnership owns the Q85: Kirby, the sole shareholder of Falcon, Inc., Q86: Kristine owns all of the stock of Q88: Which of the following statements is correct? Q90: Which of the following statements is correct? Q91: Marcus contributes property with an adjusted basis Q92: Blue, Inc., has taxable income before salary Q94: Melba contributes land (basis of $190,000; fair

![]()

A)

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents