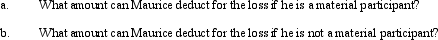

Maurice purchases a bakery from Philip for $410,000. He spends an additional $150,000 (financed with a nonrecourse loan) updating the bakery equipment. During the first year of operations as a sole proprietorship, the bakery incurs a loss of $125,000. Maurice has $300,000 of salary income as the chief financial officer of a publicly-traded corporation. He has interest income of $30,000 and dividend income of $50,000.

Correct Answer:

Verified

Q84: Alanna contributes property with an adjusted basis

Q84: Which of the following special allocations are

Q89: Candace, who is in the 33% tax

Q97: Match the following statements: Q100: Bart contributes $160,000 to the Tuna Partnership Q103: Melanie and Sonny form Bird Enterprises. Sonny Q104: Lee owns all the stock of Vireo, Q105: Daisy, Inc., has taxable income of $850,000 Q106: Albert and Bonnie each own 50% of Q112: What is the major pitfall associated with

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents