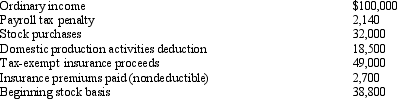

You are given the following facts about a one-shareholder S corporation, and you are asked to prepare the shareholder's ending stock basis.

A) $168,660.

B) $170,800.

C) $214,960.

D) $263,960.

Correct Answer:

Verified

Q79: Which statement is true?

A) Charitable contributions are

Q80: Which statement is false?

A) S corporation status

Q81: Which transaction affects the Other Adjustments Account

Q82: Ryan is the sole shareholder of Sweetwater

Q85: Which, if any, of the following items

Q86: On January 2, 2010, David loans his

Q87: Distributions of which assets during an S

Q88: You are given the following facts about

Q89: During 2011, Dana Rippel, the sole shareholder

Q92: Which type of distribution from an S

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents