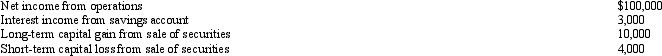

During 2011, Oxen Corporation incurs the following transactions.  Oxen maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder, Megan. As a result, Megan must recognize:

Oxen maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder, Megan. As a result, Megan must recognize:

A) Ordinary income of $103,000 and long-term capital gain of $5,000.

B) Ordinary income of $103,000, long-term capital gain of $10,000, and $4,000 short-term capital loss.

C) Ordinary income of $108,000.

D) None of the above.

Correct Answer:

Verified

Q85: Which transaction affects the Other Adjustments Account

Q92: An S corporation in Lawrence, Kansas has

Q93: Randall owns 800 shares in Fabrication, Inc.,

Q94: How large must total assets on Schedule

Q95: On January 1, Bobby and Alice own

Q96: Beginning in 2011, the AAA of Ewing,

Q99: On January 1, 2011, Zundel, Inc., an

Q100: Samantha owned 1,000 shares in Evita, Inc.,

Q101: Which tax provision does not apply to

Q102: An S corporation is limited to _

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents