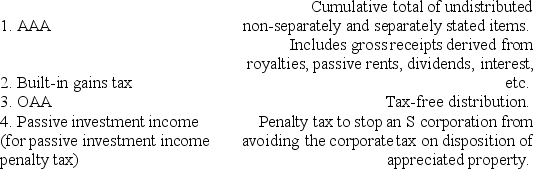

Match the term with the proper response. There may be more than one responses for each term.

Correct Answer:

Verified

Q109: For Federal income tax purposes, taxation of

Q110: Lott Corporation in Macon, Georgia converts to

Q111: Grams, Inc., a calendar year S corporation,

Q112: An S corporation with substantial AEP has

Q113: A cash basis calendar year C corporation

Q116: An S corporation may have _ class(es)

Q117: Claude Bergeron sold 1,000 shares of Ditta,

Q118: S corporation status avoids the _ taxation

Q119: A qualifying S election requires the consent

Q119: Pepper, Inc., an S corporation in Norfolk,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents