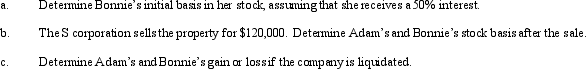

Individuals Adam and Bonnie form an S corporation, with Adam contributing cash of $100,000 for a 50% interest and Bonnie contributing appreciated ordinary income property with an adjusted basis of $20,000 and a fair market value of $100,000.

Correct Answer:

Verified

Q119: Depreciation recapture income is a _ computed

Q122: Compare the distribution of property rules for

Q142: Janet Wang is a 50% owner of

Q143: Pepper, Inc., an S corporation in Norfolk,

Q145: Explain how the domestic production activities deduction

Q146: What are the characteristics of an S

Q147: Explain how family members are treated for

Q148: You are a 60% owner of an

Q149: How may an S corporation manage its

Q150: Simmen, Inc., a calendar year S corporation,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents