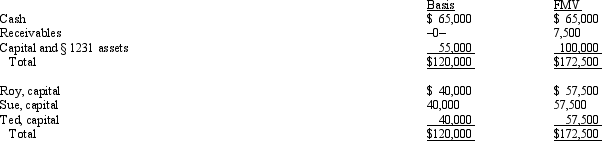

The December 31, 2011, balance sheet of the RST General Partnership reads as follows.  The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2011, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2011, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

A) If capital is NOT a material income-producing factor to the partnership, the § 736(a) payment will be $2,500.

B) If capital IS a material income-producing factor, the entire $60,000 payment will be a § 736(b) property payment.

C) The payment for Ted's share of goodwill will create $2,500 of ordinary income to him.

D) The partnership can deduct any amount that is a § 736(a) payment because it will be determined without regard to partnership profits.

E) All statements are false.

Correct Answer:

Verified

Q67: Which of the following statements about the

Q72: A partnership may make an optional election

Q74: In a proportionate liquidating distribution, Alexandria receives

Q76: In a proportionate liquidating distribution, Scott receives

Q76: Which of the following distributions would never

Q78: Last year, Darby contributed land (basis of

Q81: The December 31, 2011, balance sheet of

Q82: The December 31, 2011, balance sheet of

Q132: Nicholas is a 25% owner in the

Q134: Which of the following statements correctly reflects

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents