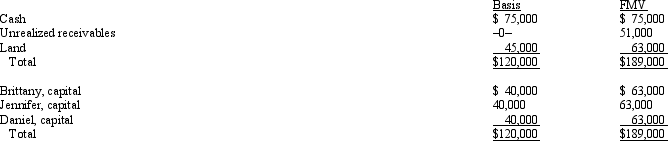

Brittany, Jennifer, and Daniel are equal partners in the BJD Partnership. The partnership balance sheet reads as follows on December 31 of the current year.  Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership step-up the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership step-up the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

A) $6,000.

B) $18,000.

C) $23,000.

D) $33,000.

E) None of the above.

Correct Answer:

Verified

Q63: Partner Jordan received a distribution of $80,000

Q64: In a proportionate liquidating distribution, Lina receives

Q65: Which of the following statements is true

Q66: Tina sells her 1/3 interest in the

Q68: Cynthia sells her 1/3 interest in the

Q69: James, Justin, and Joseph are equal partners

Q71: Last year, Jose contributed nondepreciable property with

Q72: A partnership may make an optional election

Q75: Tom and Terry are equal owners in

Q75: Which of the following is not typically

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents