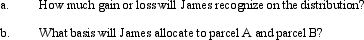

The JIH Partnership distributed the following assets to partner James in a proportionate liquidating distribution in which the partnership is liquidated: $25,000 cash, land parcel A (basis of $5,000, fair market value of $30,000), and land parcel B (basis of $5,000, fair market value of $15,000). James's basis in his partnership interest was $85,000 immediately before the distribution.

Correct Answer:

Verified

Q68: Which of the following transactions will not

Q85: Hannah sells her 25% interest in the

Q88: In a proportionate liquidating distribution in which

Q89: On August 31 of the current tax

Q92: Which of the following is not true

Q93: Chelsea owns a 25% capital and profits

Q94: The December 31, 2011, balance sheet of

Q128: Which of the following statements, if any,

Q150: Melissa is a partner in a continuing

Q224: Susan is a one-fourth limited partner in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents