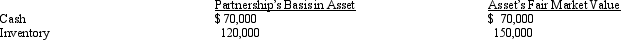

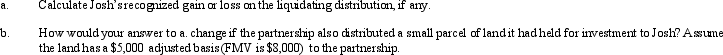

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership. His adjusted basis for his partnership interest on October 15 of the current year is $300,000. On that date, the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Correct Answer:

Verified

Q67: Which of the following statements about the

Q68: Which of the following transactions will not

Q76: Which of the following distributions would never

Q78: Last year, Darby contributed land (basis of

Q81: The December 31, 2011, balance sheet of

Q82: The December 31, 2011, balance sheet of

Q84: Cindy, a 20% general partner in the

Q85: Hannah sells her 25% interest in the

Q88: In a proportionate liquidating distribution in which

Q150: Melissa is a partner in a continuing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents