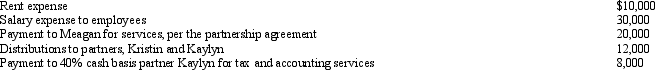

Meagan is a 40% general partner in the calendar year, cash basis MKK Partnership. The partnership received $100,000 income from services and paid the following other amounts:

How much will Meagan's adjusted gross income increase as a result of the above items?

How much will Meagan's adjusted gross income increase as a result of the above items?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Greg and Justin are forming the GJ

Q87: Jamie contributed fully depreciated ($0 basis) property

Q89: James and Kendis created the JK Partnership

Q92: During the current year, MAC Partnership reported

Q94: In the current year, the CAR Partnership

Q95: Match each of the following statements with

Q96: The MOG Partnership reports ordinary income of

Q127: Crystal contributes land to the newly formed

Q147: Katherine invested $80,000 this year to purchase

Q167: In the current year, Derek formed an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents