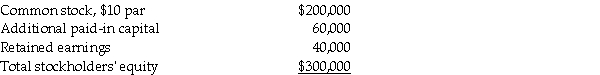

On December 31, 2013, Lorna Corporation has the following information available:

On December 31, 2013, Gerald Corporation buys an 80% interest in Lorna Corporation for $240,000. On December 31, 2013, the fair values of Lorna's assets and liabilities are equal to the respective book values.

On December 31, 2013, Gerald Corporation buys an 80% interest in Lorna Corporation for $240,000. On December 31, 2013, the fair values of Lorna's assets and liabilities are equal to the respective book values.

Required:

1. On January 1, 2014, Lorna Corporation buys 500 shares of common stock from noncontrolling stockholders at $20 per share. Prepare the journal entry for Gerald Corporation on January 1, 2014. Use four decimal places for the ownership percentage.

2. On January 1, 2014, Lorna Corporation buys 500 shares of common stock from noncontrolling stockholders at $30 per share. Prepare the journal entry for Gerald Corporation on January 1, 2014. Use four decimal places for the ownership percentage.

3. On January 1, 2014, Lorna Corporation buys 500 shares of common stock from noncontrolling stockholders at $10 per share. Prepare the journal entry for Gerald Corporation on January 1, 2014. Use four decimal places for the ownership percentage.

Correct Answer:

Verified

16,000/19,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: On December 31, 2013, Potter Corporation has

Q22: At December 31, 2013, the stockholders' equity

Q22: On September 1,2013,Nelson Corporation acquired a 90%

Q23: Candy Corporation paid $240,000 on April 1,

Q24: Justice Corporation paid $40,000 cash for an

Q25: On December 31, 2013, Dixie Corporation has

Q25: On September 1,2013,Beck Corporation acquired an 80%

Q28: At January 1, 2013, the stockholders' equity

Q29: On December 31, 2013, Pat Corporation has

Q33: On January 1,2013,Starling Corporation held an 80%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents