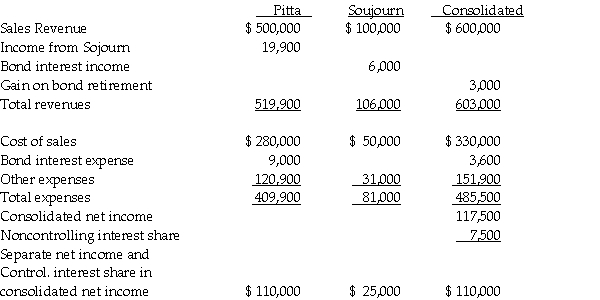

Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31, 2013 are summarized as follows:

The interest income and expense eliminations relate to a $100,000, 9% bond issue that was issued at par value and matures on January 1, 2018. On January 2, 2013, a portion of the bonds was purchased and constructively retired.

The interest income and expense eliminations relate to a $100,000, 9% bond issue that was issued at par value and matures on January 1, 2018. On January 2, 2013, a portion of the bonds was purchased and constructively retired.

Required: Answer the following questions.

1. Which company is the issuing affiliate of the bonds payable?

2. What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2013?

3. What portion of the bonds payable is held by nonaffiliates at December 31, 2013?

4. Is Sojourn a wholly-owned subsidiary? If not, what percentage does Pitta own?

5. Does the purchasing affiliate use straight-line or effective interest amortization?

6. Explain the calculation of Pitta's $19,900 income from Sojourn.

Correct Answer:

Verified

Q4: There are several theories for allocating constructive

Q7: Use the following information to answer

Q16: Use the following information to answer the

Q23: Paleo Corporation holds 80% of the capital

Q27: Patama Holdings owns 70% of Seagull Corporation.

Q28: Pelami Corporation owns a 90% interest in

Q28: Pass Corporation owns 80% of Sindy Company,

Q32: Pongo Company has $2,000,000 of 6% bonds

Q35: Parkview Holdings owns 70% of Skyline Corporation.On

Q40: Spott is a 75%-owned subsidiary of Penthal.On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents