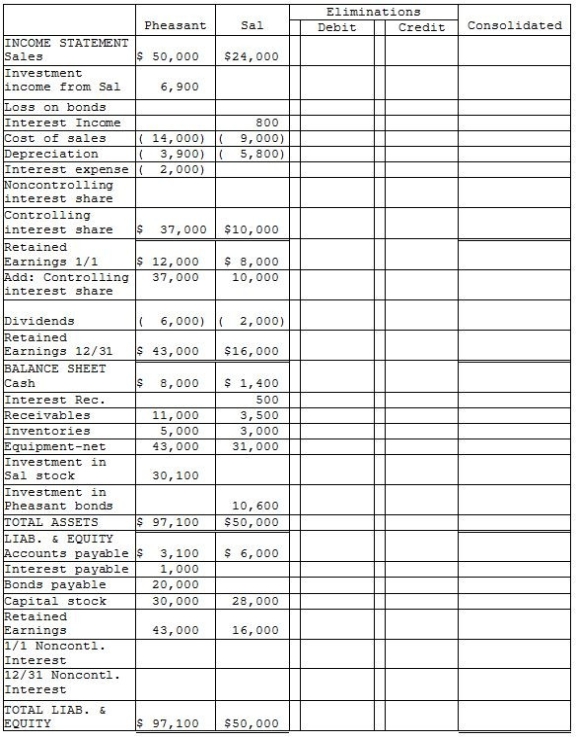

Pheasant Corporation owns 80% of Sal Corporation's outstanding common stock that was purchased at book value equal to fair value on January 1, 2007.

Additional information:

1. Pheasant sold inventory items that cost $3,000 to Sal during 2014 for $6,000. One-half of this merchandise was inventoried by Sal at year-end. At December 31, 2014, Sal owed Pheasant $2,000 on account from the inventory sales. No other intercompany sales of inventory have occurred since Pheasant acquired its interest in Sal.

2. Pheasant sold equipment with a book value of $5,000 and a 5-year useful life to Sal for $10,000 on December 31, 2012. The equipment remains in use by Sal and is depreciated by the straight-line method. The equipment has no salvage value.

3. On January 2, 2014, Sal paid $10,800 for $10,000 par value of Pheasant's 10-year, 10% bonds. These bonds were originally sold at par value, and have interest payment dates of January 1 and July 1, and mature on January 1, 2018. Straight-line amortization has been applied by Sal to the Pheasant bond investment.

4. Pheasant uses the equity method in accounting for its investment in Sal.

Required:

Complete the working papers to consolidate the financial statements of Pheasant Corporation and Sal for the year ended December 31, 2014.

Correct Answer:

Verified

Q27: Patama Holdings owns 70% of Seagull Corporation.

Q28: Pass Corporation owns 80% of Sindy Company,

Q28: Pelami Corporation owns a 90% interest in

Q29: Phlora purchased its 100% ownership in Speshal

Q29: Peter Corporation owns a 70% interest in

Q30: Snackle Inc.is a 90%-owned subsidiary of Pasha

Q31: Padma Corporation owns 70% of the outstanding

Q31: Sabu is a 65%-owned subsidiary of Peerless.On

Q35: Paka Corporation owns an 80% interest in

Q40: Spott is a 75%-owned subsidiary of Penthal.On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents