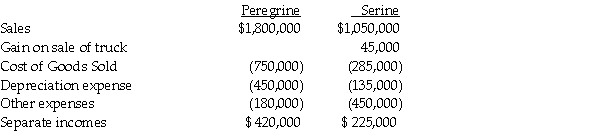

Peregrine Corporation acquired an 80% interest in Serine Corporation in 2011 at a time when Serine's book values and fair values were equal to one another. On January 1, 2014, Serine sold a truck with a $55,000 book value to Peregrine for $100,000. Peregrine is depreciating the truck over 10 years using the straight-line method. The truck has no salvage value. Separate incomes for Peregrine and Serine for 2014 were as follows:  Peregrine's investment income from Serine for 2014 was

Peregrine's investment income from Serine for 2014 was

A) $108,000.

B) $144,000.

C) $147,600.

D) $180,000.

Correct Answer:

Verified

Q8: Use the following information to answer the

Q9: After eliminating/adjusting entries are prepared, what was

Q11: Parrot Company owns all the outstanding voting

Q12: Assume an upstream sale of machinery occurs

Q13: On January 1,2014 Saffron Co.recorded a $40,000

Q14: Parrot Corporation acquired a 70% interest in

Q15: Pogo Corporation acquired a 75% interest in

Q16: Which of the following is correct?

A)No consolidation

Q18: Use the following information to answer the

Q19: Pied Imperial Corporation acquired a 90% interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents