Plower Corporation acquired all of the outstanding voting common stock of the Squab Corporation several years ago when the book values and fair values of Squab's net assets were equal.

On April 1, 2012, Plower sold land that cost $25,000 to Squab for $40,000. Squab resold the land for $45,000 on December 1, 2014.

On July 1, 2014, Plower sold equipment with a book value of $10,000 to Squab for $26,000. Squab is depreciating the equipment over a four-year period using the straight-line method. The equipment has no salvage value.

Required:

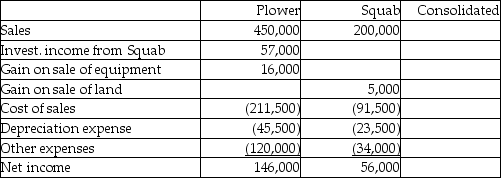

The first two columns in the working papers presented below summarize income statement information from the separate company financial statements of Plower and Squab for the year ended December 31, 2014. Fill in the consolidated working paper columns to show how each of the items from the separate company reports will appear in the consolidated income statement for the year ended December 31, 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Use the following information to answer the

Q19: Petrol Company acquired an 90% interest in

Q20: On January 1, 2014, Bigg Corporation sold

Q21: Pollek Corporation paid $16,200 for a 90%

Q22: On January 1, 2013, Pilgrim Imaging purchased

Q24: Palmer Corporation purchased 75% of Stone Industries'

Q25: Pigeon Company owns 80% of the outstanding

Q26: Separate income statements of Plantation Corporation and

Q26: Porter Corporation acquired 70% of the outstanding

Q28: On January 2,2014,Pal Corporation sold warehouse equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents