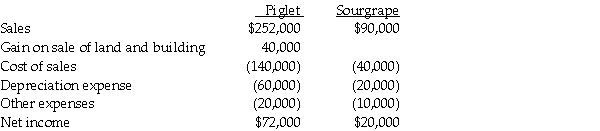

Piglet Incorporated purchased 90% of the outstanding stock of Sourgrape Company several years ago at book value. At January 1, 2012, Sourgrape sold land with a book value of $30,000 to Piglet at its fair market value of $40,000. At the same time, Sourgrape sold the building that was on the land to Piglet. The building had a book value of $80,000 and was sold at its fair value of $120,000. The building had a remaining useful life of 8 years and is depreciated using the straight-line method. The building has no salvage value. On January 1, 2014, Piglet sold the land and building to a third party. The sales price was allocated so that the land was sold for $50,000 and the building was sold for $150,000. Income statements for Piglet and Sourgrape for the year ended December 31, 2014 are summarized below:

Required:

Required:

Prepare the eliminating/adjusting entries related to the land and building on the consolidated working papers on the following dates:

1. December 31, 2012

2. December 31, 2013

3. December 31, 2014

Correct Answer:

Verified

Q23: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q30: Passo Corporation acquired a 70% interest in

Q31: Separate income statements of Pingair Corporation and

Q32: Snow Company is a wholly owned subsidiary

Q32: Pierce Manufacturing owns all of the outstanding

Q34: Park Incorporated purchased a 70% interest in

Q35: Several years ago,Peacock International purchased 80% of

Q36: Plock Corporation,the 75% owner of Seraphim Company,reported

Q38: Prey Corporation created a wholly owned subsidiary,

Q39: Several years ago,Pilot International purchased 70% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents