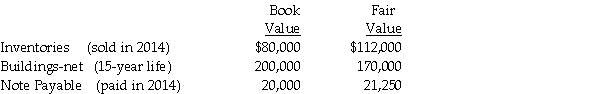

Petra Corporation paid $500,000 for 80% of the outstanding voting common stock of Sizable Corporation on January 2, 2014 when the book value of Sizable's net assets was $460,000. The fair values of Sizable's identifiable net assets were equal to their book values except as indicated below.

Sizable reported net income of $75,000 during 2014; dividends of $35,000 were declared and paid during the year.

Sizable reported net income of $75,000 during 2014; dividends of $35,000 were declared and paid during the year.

Required:

1. Prepare a schedule to allocate the fair value/book value differential to the specific identifiable assets and liabilities.

2. Determine Petra's income from Sizable for 2014.

3. Determine the correct balance in the Investment in Sizable account as of December 31, 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: On July 1,2014,Polliwog Incorporated paid cash for

Q29: Passcode Incorporated acquired 90% of Safe Systems

Q30: Pamula Corporation paid $279,000 for 90% of

Q31: On January 1, 2014, Pinnead Incorporated paid

Q33: Pattalle Co purchases Senday, Inc. on January

Q34: Pal Corporation paid $5,000 for a 60%

Q35: On January 2, 2014, Power Incorporated paid

Q37: On January 1, 2014, Myna Corporation issued

Q38: Patterson Company acquired 90% of Starr Corporation

Q39: Pool Industries paid $540,000 to purchase 75%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents