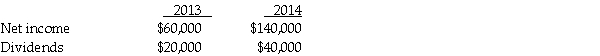

Pike Corporation paid $100,000 for a 10% interest in Salmon Corp. on January 1, 2013, when Salmon's stockholders' equity consisted of $800,000 of $10 par value common stock and $200,000 retained earnings. On December 31, 2014, after receipt of the year's dividends from Salmon, Pike paid $192,000 for an additional 20% interest in Salmon Corp. Both of Pike's investments were made when Salmon's book values equaled their fair values. Salmon's net income and dividends for 2013 and 2014 were as follows:

Required:

Required:

1. Prepare journal entries for Pike Corporation to account for its investment in Salmon Corporation for 2013 and 2014.

2. Calculate the balance of Pike's investment in Salmon at December 31, 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Pearl Corporation paid $150,000 on January 1,2013

Q25: Shebing Corporation had $80,000 of $10 par

Q27: On January 1, 2013, Pailor Inc. purchased

Q29: For 2013 and 2014,Sabil Corporation earned net

Q30: Sandpiper Inc. acquired a 30% interest in

Q34: On January 1, 2013, Petrel, Inc. purchased

Q35: Plum Corporation paid $700,000 for a 40%

Q36: Pancake Corporation saw the potential for vertical

Q36: On January 2,2013,Slurg Corporation paid $600,000 to

Q38: Shoreline Corporation had $3,000,000 of $10 par

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents