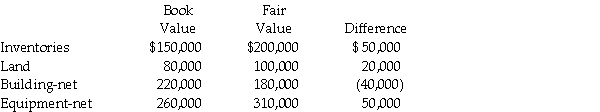

Paster Corporation was seeking to expand its customer base, and wanted to acquire a company in a market area it had not yet served. Paster determined that the Semma Company was already in the market they were pursuing, and on January 1, 2013, purchased a 25% interest in Semma to assure access to Semma's customer base. Paster paid $800,000, at a time when the book value of Semma's net equity was $3,000,000. Semma's book values equaled their fair values except for the following items:

Required:

Required:

Prepare a schedule to allocate any excess purchase cost to identifiable assets and goodwill.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: In reference to the determination of goodwill

Q7: Use the following information to answer the

Q16: Which method of accounting will generally be

Q18: Which method of accounting will generally be

Q19: Pelican Corporation acquired a 25% interest in

Q23: Wader's Corporation paid $120,000 for a 25%

Q24: On January 1, 2013, Palgan, Co. purchased

Q25: On January 1, 2013, Platt Corporation purchased

Q26: Dotterel Corporation paid $200,000 cash for 40%

Q34: Firms must conduct impairment tests more frequently

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents