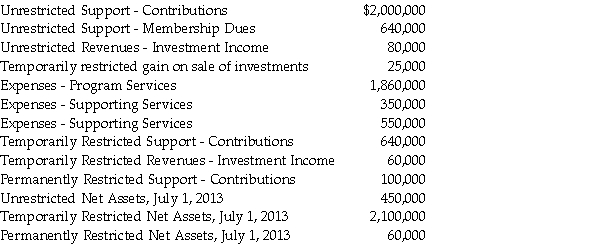

The following information was taken from the accounts and records of the Helping Hands Foundation, a private, not-for-profit organization classified as a VHWO. All balances are as of June 30, 2014, unless otherwise noted.

The unrestricted support from contributions was received in cash during the year. The expenses included $1,350,000 paid from temporarily-restricted cash donations.

The unrestricted support from contributions was received in cash during the year. The expenses included $1,350,000 paid from temporarily-restricted cash donations.

Required:

Prepare Helping Hands' Statement of Activities for the fiscal year ended June 30, 2014.

Correct Answer:

Verified

Q21: Marshfield Hospital is a private,not-for-profit hospital.The following

Q22: A small town in a rural area

Q25: A private,not-for-profit university received donations of $800,000

Q32: General Hospital is a private,not-for-profit hospital.The following

Q33: A private,not-for-profit university received donations of $1,000,000

Q34: The Trasque Hospital is a nongovernmental,not-for-profit hospital.During

Q34: The following information was taken from the

Q36: The following information is available about the

Q37: Albatross University,a not-for-profit,nongovernmental university,had the following transactions

Q37: Southtown Community Hospital (SCH) shows the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents