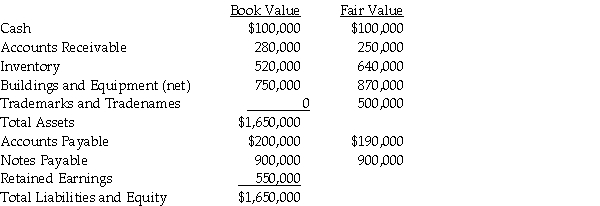

At December 31, 2013, Pandora Incorporated issued 40,000 shares of its $20 par common stock for all the outstanding shares of the Sophocles Company. In addition, Pandora agreed to pay the owners of Sophocles an additional $200,000 if a specific contract achieved the profit levels that were targeted by the owners of Sophocles in their sale agreement. The fair value of this amount, with an agreed likelihood of occurrence and discounted to present value, is $160,000. In addition, Pandora paid $10,000 in stock issue costs, $40,000 in legal fees, and $48,000 to employees who were dedicated to this acquisition for the last three months of the year. Summarized balance sheet and fair value information for Sophocles immediately prior to the acquisition follows.

Required:

Required:

1. Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $35 at the date of acquisition and Sophocles dissolves as a separate legal entity.

2. Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $35 at the date of acquisition and Sophocles continues as a separate legal entity.

3. Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $25 at the date of acquisition and Sophocles dissolves as a separate legal entity.

4. Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $25 at the date of acquisition and Sophocles survives as a separate legal entity.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Which of the following is not a

Q12: Following the accounting concept of a business

Q20: Use the following information to answer the

Q21: Pali Corporation exchanges 200,000 shares of newly

Q22: On December 31, 2013, Peris Company acquired

Q24: Samantha's Sporting Goods had net assets consisting

Q25: The balance sheets of Palisade Company and

Q26: On June 30, 2013, Stampol Company ceased

Q27: Pony acquired Spur Corporation's assets and liabilities

Q28: Saveed Corporation purchased the net assets of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents