Use the following information to answer the question(s) below.

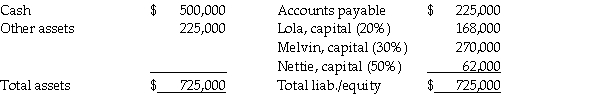

Lola, Melvin, and Nettie are in the process of liquidating their partnership. Since it may take several months to convert the other assets into cash, the partners agree to distribute all available cash immediately, except for $12,000 that is set aside for contingent expenses. The balance sheet and residual profit and loss sharing percentages are as follows:

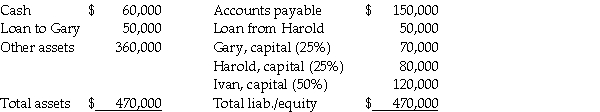

-The year-end balance sheet and residual profit and loss sharing percentages for the Gary, Harold, and Ivan partnership on December 31, 2014, are as follows:  The partners agree to liquidate the business and distribute cash when it becomes available. A cash distribution plan is developed with vulnerability rankings for the Gary, Harold and Ivan partnership. After outside creditors are paid, the cash available will initially go to

The partners agree to liquidate the business and distribute cash when it becomes available. A cash distribution plan is developed with vulnerability rankings for the Gary, Harold and Ivan partnership. After outside creditors are paid, the cash available will initially go to

A) Gary in the amount of $20,000.

B) Harold in the amount of $50,000.

C) Harold in the amount of $70,000.

D) Ivan in the amount of $40,000.

Correct Answer:

Verified

Q1: Creditors of the partnership may seek the

Q3: How much cash would Baker receive from