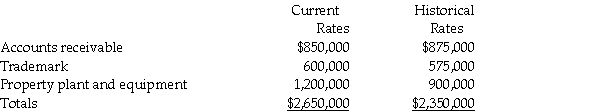

The following assets of Poole Corporation's Romanian subsidiary have been converted into U.S. dollars at the following exchange rates:  Assume the functional currency of the subsidiary is the U.S. dollar and the books are kept in a different currency. The assets should be reported in the consolidated financial statements of Poole Corporation and Subsidiary in the total amount of

Assume the functional currency of the subsidiary is the U.S. dollar and the books are kept in a different currency. The assets should be reported in the consolidated financial statements of Poole Corporation and Subsidiary in the total amount of

A) $2,325,000.

B) $2,350,000.

C) $2,375,000.

D) $2,650,000.

Correct Answer:

Verified

Q1: A U.S.firm has a Belgian subsidiary that

Q2: When translating foreign subsidiary income statements using

Q6: Which of the following assets and/or liabilities

Q8: At the time of a business acquisition,

A)identifiable

Q12: Accounts representing an allowance for uncollectible accounts

Q14: Exchange gains or losses from remeasurement appear

A)in

Q17: The primary goal behind consolidating financial statements

Q18: Which of the following statements about the

Q19: Palk Corporation has a foreign subsidiary located

Q20: Paskin Corporation's wholly-owned Canadian subsidiary has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents