Plane Corporation, a U.S. company, owns 100% of Shipp Corporation, a Libyan company. Shipp's equipment was acquired on the following dates (amounts are stated in Libyan dinars):

Jan. 01, 2014 Purchased equipment for 40,000 dinars

Jul. 01, 2014 Purchased equipment for 80,000 dinars

Jan. 01, 2015 Purchased equipment for 50,000 dinars

Jul. 01, 2015 Sold equipment purchased on Jan. 01, 2014 for 35,000 dinars

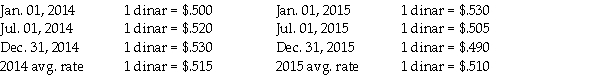

Exchange rates for the Libyan dinars on various dates are:

Shipp's equipment has an estimated 5-year life with no salvage value and is depreciated using the straight-line method, calculating depreciation expense on a monthly basis. Shipp's functional currency is the U.S. dollar, but the company uses the Libyan dinar as its reporting currency.

Shipp's equipment has an estimated 5-year life with no salvage value and is depreciated using the straight-line method, calculating depreciation expense on a monthly basis. Shipp's functional currency is the U.S. dollar, but the company uses the Libyan dinar as its reporting currency.

Required:

1. Determine the value of Shipp's equipment account on December 31, 2015 in U.S. dollars.

2. Determine Shipp's depreciation expense for 2015 in U.S. dollars.

3. Determine the gain or loss from the sale of equipment on July 1, 2015 in U.S. dollars.

Correct Answer:

Verified

Q29: Each of the following accounts has been

Q30: On January 1, 2014, Paste Unlimited, a

Q31: On January 1, 2014, Psalm Corporation purchased

Q32: Pew Corporation (a U.S. corporation) acquired all

Q33: Puddle Incorporated purchased an 80% interest in

Q34: Note to Instructor: This exam item is

Q35: Pan Corporation, a U.S. company, formed a

Q37: Note to Instructor: This exam item is

Q38: Pritt Company purchased all the outstanding stock

Q39: Phim Inc., a U.S. company, owns 100%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents