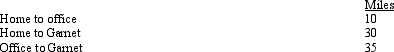

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year, she is permanently assigned to the team auditing Garnet Corporation.As a result, every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months, Amy's deductible mileage for each workday is:

For these three months, Amy's deductible mileage for each workday is:

A) 0.

B) 30.

C) 35.

D) 60.

E) None of the above.

Correct Answer:

Verified

Q81: In which, if any, of the following

Q85: In terms of meeting the distance test

Q86: Which, if any, of the following factors

Q89: As to meeting the time test for

Q90: During the year, Oscar travels from Raleigh

Q91: A worker may prefer to be classified

Q96: Dave is the regional manager for a

Q98: Statutory employees:

A) Report their expenses on Schedule

Q99: During the year, Peggy went from Nashville

Q100: During the year, Walt went from Louisville

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents