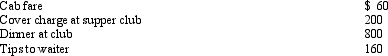

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation, Henry's deduction is:

Presuming proper substantiation, Henry's deduction is:

A) $1,220.

B) $740.

C) $640.

D) $610.

E) None of the above.

Correct Answer:

Verified

Q102: Beth, age 51, has a traditional deductible

Q103: The § 222 deduction for tuition and

Q104: Kay, a single individual, participates in her

Q105: Joyce, age 39, and Sam, age 40,

Q107: Which of the following expenses, if any,

Q108: One of the tax advantages of being

Q112: Which, if any, of the following expenses

Q114: Which, if any, of the following expenses

Q115: A participant, who is age 38, in

Q116: Which, if any, of the following expenses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents