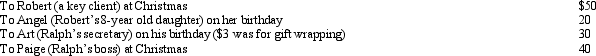

Ralph made the following business gifts during the year.  Presuming proper substantiation, Ralph's deduction is:

Presuming proper substantiation, Ralph's deduction is:

A) $0.

B) $53.

C) $73.

D) $78.

E) $98.

Correct Answer:

Verified

Q101: Donna, age 27 and unmarried, is an

Q102: Beth, age 51, has a traditional deductible

Q103: The § 222 deduction for tuition and

Q106: In contrasting the reporting procedures of employees

Q106: Frank established a Roth IRA at age

Q108: One of the tax advantages of being

Q110: Elaine, the regional sales director for a

Q115: A participant, who is age 38, in

Q120: Sammy, age 31, is unmarried and is

Q121: Marcie moved from Oregon to West Virginia

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents