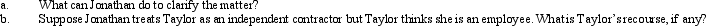

Taylor performs services for Jonathan on a regular basis.There exists considerable doubt as to whether Taylor is an employee or an independent contractor.

Correct Answer:

Verified

Q106: Myra's classification of those who work for

Q117: When is a taxpayer's work assignment in

Q123: Christopher just purchased an automobile for $40,000

Q125: In terms of income tax treatment, what

Q134: Concerning the deduction for moving expenses, what

Q139: Nicole just retired as a partner in

Q142: Meg teaches the fifth grade at a

Q148: Regarding § 222 (qualified higher education deduction

Q156: In connection with the office in the

Q157: In terms of IRS attitude, what do

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents