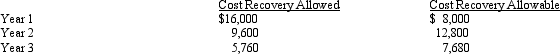

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are as follows:  If Tara sells the machine after three years for $15,000, how much gain should she recognize?

If Tara sells the machine after three years for $15,000, how much gain should she recognize?

A) $3,480.

B) $6,360.

C) $9,240.

D) $11,480.

E) None of the above.

Correct Answer:

Verified

Q28: For real property, the ADS convention is

Q33: Goodwill associated with the acquisition of a

Q37: A purchased trademark is a § 197

Q41: Intangible drilling costs may be expensed rather

Q41: On June 1 of the current year,

Q50: The cost of a covenant not to

Q51: Bonnie purchased a new business asset (five-year

Q55: The amortization period in 2012 for $4,000

Q57: Tan Company acquires a new machine (ten-year

Q59: Grape Corporation purchased a machine in December

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents