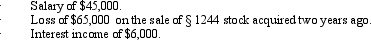

John files a return as a single taxpayer.In 2012, he had the following items:  Determine John's AGI for 2012.

Determine John's AGI for 2012.

A) ($5,000) .

B) $0.

C) $45,000.

D) $51,000.

E) None of the above.

Correct Answer:

Verified

Q42: Peggy is in the business of factoring

Q44: An unreimbursed employee business expense can create

Q46: On June 2, 2011, Fred's TV Sales

Q48: Which of the following events would produce

Q49: Three years ago, Sharon loaned her sister

Q51: On February 20, 2011, Bill purchased stock

Q51: In 2012, Wally had the following insured

Q52: Five years ago, Tom loaned his son

Q55: A farming NOL may be carried back

Q59: Jed is an electrician. Jed and his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents