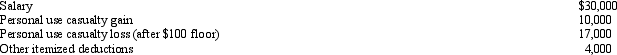

In 2012, Mary had the following items:  Assuming that Mary files as head of household (has one dependent child) , determine her taxable income for the current year.

Assuming that Mary files as head of household (has one dependent child) , determine her taxable income for the current year.

A) $13,700.

B) $14,100.

C) $14,300.

D) $24,300.

E) None of the above.

Correct Answer:

Verified

Q63: Regarding research and experimental expenditures, which of

Q69: Alma is in the business of dairy

Q74: Norm's car, which he uses 100% for

Q77: In 2012, Juan's home was burglarized.Juan had

Q78: In 2012, Morley, a single taxpayer, had

Q80: For the year 2012, Amber Corporation has

Q81: In 2011, Tan Corporation incurred the following

Q82: Mike, single, age 31, had the following

Q84: In 2011, Robin Corporation incurred the following

Q85: Susan has the following items for 2012:

·

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents