Emelie and Taylor are employed by the Federal government and own their home in Washington,

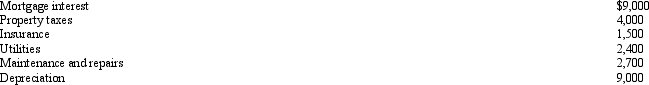

D.C.While vacationing in the summer for three weeks, they rent their home for two weeks to an Angolian diplomat for $3,000.During the third week, they permit Taylor's aunt and uncle to stay in the house with no rent being charged.Expenses associated with the home for the year are as follows:

Determine the effect of these income and expense items associated with their home if they file a joint return.

Determine the effect of these income and expense items associated with their home if they file a joint return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Robin and Jeff own an unincorporated hardware

Q105: Alfred's Enterprises, an unincorporated entity, pays employee

Q108: In order to protect against rent increases

Q109: Albie operates an illegal drug-running business and

Q111: Kitty runs a brothel (illegal under state

Q111: Sandra sold 500 shares of Wren Corporation

Q112: Walter sells land with an adjusted basis

Q113: The stock of Eagle, Inc.is owned as

Q114: Rose's business sells air conditioners which have

Q115: Sandra owns an insurance agency.The following selected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents