During the year, Martin rented his vacation home for three months and spent one month there.Gross rental income from the property was $5,000.Martin incurred the following expenses: mortgage interest, $3,000; real estate taxes, $1,500; utilities, $800; maintenance, $500; and depreciation, $4,000.Compute Martin's allowable deductions for the vacation home.

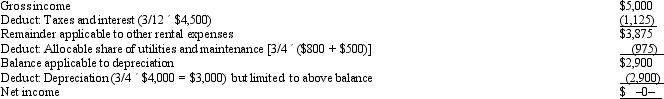

Since the vacation home is rented for 15 or more days and is used for personal purposes for more than the greater of (1) 14 days or (2) 10% of the rental days, the deductions are scaled down, using the court's approach, as follows:

Thus, Martin may deduct $1,125 taxes and interest, $975 utilities and maintenance, and $2,900 depreciation against the gross income of $5,000.The personal portion of taxes and interest ($3,375) is deductible as an itemized deduction.Example 29

Thus, Martin may deduct $1,125 taxes and interest, $975 utilities and maintenance, and $2,900 depreciation against the gross income of $5,000.The personal portion of taxes and interest ($3,375) is deductible as an itemized deduction.Example 29

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Beige, Inc., an airline manufacturer, is conducting

Q102: Taylor, a cash basis architect, rents the

Q102: During the year, Jim rented his vacation

Q113: The stock of Eagle, Inc.is owned as

Q114: Rose's business sells air conditioners which have

Q115: Sandra owns an insurance agency.The following selected

Q116: Gladys owns a retail hardware store in

Q124: Are all personal expenses disallowed as deductions?

Q127: Graham, a CPA, has submitted a proposal

Q140: In applying the $1 million limit on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents