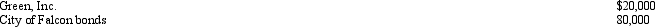

Brenda invested in the following stocks and bonds during 2012.

To finance the investments, she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2012 was $6,000.During 2012, Brenda received $2,400 of dividend income from Green, Inc.and $3,200 of interest income on the municipal bonds.

To finance the investments, she borrowed $100,000 from Swan Bank.Interest expense paid on the loan during 2012 was $6,000.During 2012, Brenda received $2,400 of dividend income from Green, Inc.and $3,200 of interest income on the municipal bonds.

Correct Answer:

Verified

Q116: Trade or business expenses are classified as

Q121: How can an individual's consultation with a

Q127: Salaries are considered an ordinary and necessary

Q128: Abner contributes $1,000 to the campaign of

Q129: If part of a shareholder/employee's salary is

Q132: Briefly discuss the two tests that an

Q133: What losses are deductible by an individual

Q136: Bruce owns several sole proprietorships. Must Bruce

Q139: Are there any circumstances under which lobbying

Q143: Under what circumstances may a taxpayer deduct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents