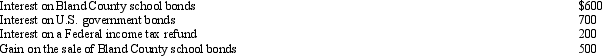

Heather's interest and gains on investments for 2012 were as follows:  Heather's gross income from the above is:

Heather's gross income from the above is:

A) $2,000.

B) $1,800.

C) $1,400.

D) $1,300.

E) None of the above.

Correct Answer:

Verified

Q81: Martha participated in a qualified tuition program

Q88: In December 2012, Todd, a cash basis

Q91: Hazel, a solvent individual but a recovering

Q93: The exclusion of interest on educational savings

Q95: Sandy is married, files a joint return,

Q96: George, an unmarried cash basis taxpayer, received

Q99: Assuming a taxpayer qualifies for the exclusion

Q107: If a tax-exempt bond will yield approximately

Q109: Ben was hospitalized for back problems. While

Q111: Carmen had worked for Sparrow Corporation for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents