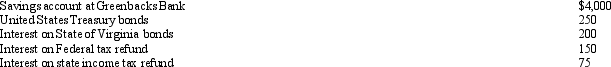

Doug and Pattie received the following interest income in the current year:  Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

A) $4,775.

B) $4,675.

C) $4,575.

D) $4,300.

E) None of the above.

Correct Answer:

Verified

Q80: Under the Swan Company's cafeteria plan, all

Q82: In the case of interest income from

Q83: Louise works in a foreign branch of

Q85: Gold Company was experiencing financial difficulties, but

Q87: Emily is in the 35% marginal tax

Q95: Beverly died during the current year. At

Q96: Harold bought land from Jewel for $150,000.Harold

Q97: Stuart owns 300 shares of Turquoise Corporation

Q98: Denny was neither bankrupt nor insolvent but

Q100: On January 1, 2002, Cardinal Corporation issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents