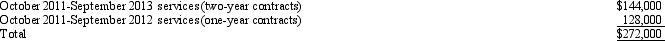

Orange Cable TV Company, an accrual basis taxpayer, allows its customers to pay by the year in advance ($500 per year) , or two years in advance ($950) .In September 2011, the company collected the following amounts applicable to future services:  As a result of the above, Orange Cable should report as gross income:

As a result of the above, Orange Cable should report as gross income:

A) $272,000 in 2011.

B) $128,000 in 2011.

C) $168,000 in 2012.

D) $222,000 in 2012.

E) None of the above.

Correct Answer:

Verified

Q65: On January 5, 2012, Tim purchased a

Q66: Wayne owns a 25% interest in the

Q68: The Purple & Gold Gym, Inc., uses

Q74: Mike contracted with Kram Company, Mike's controlled

Q78: Under the alimony rules:

A)The income is included

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents