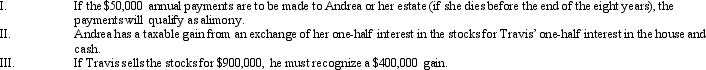

Travis and Andrea were divorced.Their only marital property consisted of a personal residence (fair market value of $400,000, cost of $200,000) , and publicly-traded stocks (fair market value of $800,000, cost basis of $500,000) .Under the terms of the divorce agreement, Andrea received the personal residence and Travis received the stocks.In addition, Andrea was to receive $50,000 for eight years.

A) Only III is true.

B) Only I and III are true.

C) Only I and II are true.

D) I, II, and III are true.

E) None of the above are true.

Correct Answer:

Verified

Q81: In the case of a below-market loan

Q83: Sharon made a $60,000 interest-free loan to

Q84: Thelma and Mitch were divorced.The couple had

Q90: Which of the following is not a

Q93: The alimony recapture rules are intended to:

A)Assist

Q101: Ted loaned money to a business acquaintance.

Q106: Roy is considering purchasing land for $10,000.He

Q112: Ted was shopping for a new automobile.

Q112: The amount of Social Security benefits received

Q119: José, a cash method taxpayer, is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents