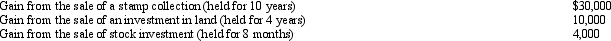

Perry is in the 33% tax bracket.During 2012, he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

A) (15% ´ $30,000) + (33% ´ $4,000) .

B) (15% ´ $10,000) + (28% ´ $30,000) + (33% ´ $4,000) .

C) (0% ´ $10,000) + (28% ´ $30,000) + (33% ´ $4,000) .

D) (15% ´ $40,000) + (33% ´ $4,000) .

E) None of the above.

Correct Answer:

Verified

Q82: Merle is a widow, age 80 and

Q85: Evan and Eileen Carter are husband and

Q87: Emily, whose husband died in December 2011,

Q97: Millie, age 80, is supported during the

Q99: During 2012, Jen (age 66) furnished more

Q101: Heloise, age 74 and a widow, is

Q104: Warren, age 17, is claimed as a

Q104: During the year, Kim sold the following

Q108: Tom is single and for 2012 has

Q118: Meg, age 23, is a full-time law

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents