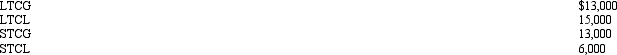

During 2012, Madison had salary income of $80,000 and the following capital transactions:

How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: In resolving qualified child status for dependency

Q123: Deductions for AGI are often referred to

Q134: Contrast the tax consequences resulting from the

Q136: In meeting the criteria of a qualifying

Q137: When can a taxpayer not use Form

Q139: Jayden and Chloe Harper are husband and

Q142: The major advantage of being classified as

Q152: During the current year, Doris received a

Q158: Under what circumstances, if any, may an

Q158: Maude's parents live in another state and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents