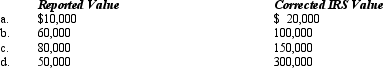

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case, assume a marginal estate tax rate of 45%.

Correct Answer:

Verified

Q121: Certain individuals are more likely than others

Q125: Bettie, a calendar year individual taxpayer, files

Q126: Leo underpaid his taxes by $250,000.Portions of

Q128: Clara underpaid her taxes by $50,000.Of this

Q132: Yin-Li is the preparer of the Form

Q135: The IRS periodically updates its list of

Q140: Troy Center Ltd.withheld from its employees' paychecks

Q153: The Treasury issues "private letter rulings" and

Q156: A tax professional needs to know how

Q169: A taxpayer penalty may be waived if

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents