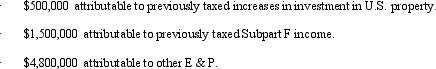

Xenia, Inc., a U.S.shareholder, owns 100% of Fredonia, a CFC.Xenia receives a $3 million cash distribution from Fredonia.Fredonia's E & P is composed of the following amounts.  Xenia recognizes a taxable dividend of:

Xenia recognizes a taxable dividend of:

A) $3 million.

B) $2.5 million.

C) $1.5 million.

D) $1 million.

E) $0.

Correct Answer:

Verified

Q53: Section 482 is used by the Treasury

Q56: Generally, accrued foreign income taxes are translated

Q58: A tax haven often is:

A) A country

Q65: OutCo, a controlled foreign corporation in Meena,

Q67: Kilps,a U.S.corporation,receives a $200,000 dividend from a

Q73: A controlled foreign corporation (CFC) realizes Subpart

Q75: Copp, Inc., a domestic corporation, owns 30%

Q76: Amber, Inc., a domestic corporation receives a

Q78: RedCo, a domestic corporation, incorporates its foreign

Q80: Which of the following income items does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents