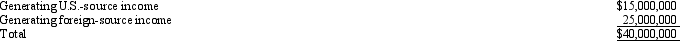

Goolsbee, Inc., a domestic corporation, generates U.S.-source and foreign-source gross income.Goolsbee's assets (tax book value) are as follows.

Goolsbee incurs interest expense of $200,000.Using the asset method and the tax book value, apportion interest expense to foreign-source income.

Goolsbee incurs interest expense of $200,000.Using the asset method and the tax book value, apportion interest expense to foreign-source income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Which of the following foreign taxes paid

Q122: Which of the following statements regarding the

Q124: KeenCo, a domestic corporation, is the sole

Q125: Present, Inc., a domestic corporation, owns 60%

Q126: SunCo, a domestic corporation, owns a number

Q127: Match the definition with the correct term.

Q127: Which of the following statements regarding the

Q128: Britta, Inc., a U.S.corporation, reports foreign-source income

Q138: Which of the following statements regarding the

Q140: USCo, a domestic corporation, reports worldwide taxable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents