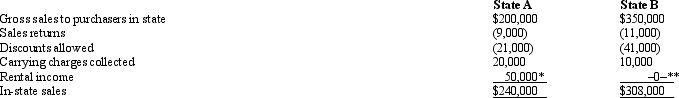

Shaker Corporation operates in two states, as indicated below.All goods are manufactured in State

A.Determine the sales to be assigned to both states to be used in computing Shaker's sales factor for the year.Both states follow the UDITPA and the MTC regulations in this regard.

* Excess warehouse space

* Excess warehouse space

** Land held for speculation

* Excess warehouse space, related to business

* Excess warehouse space, related to business

** Land held for speculation, nonbusiness income

Correct Answer:

Verified

** La...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: A number of court cases in the

Q124: You are completing the State A income

Q127: Mercy Corporation, headquartered in F, sells wireless

Q127: Hermann Corporation is based in State A

Q128: Kim Corporation, a calendar year taxpayer, has

Q131: Milt Corporation owns and operates two facilities

Q133: Dott Corporation generated $300,000 of state taxable

Q137: Compost Corporation has finished its computation of

Q172: In international taxation, we discuss income sourcing

Q191: Your supervisor has shifted your responsibilities from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents