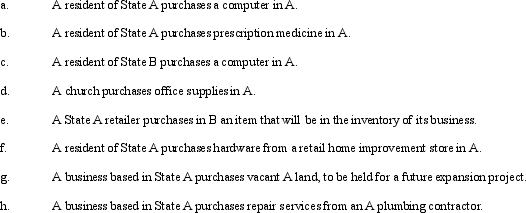

Indicate for each transaction whether a sales (S) or use (U) applies, or whether the transaction is nontaxable (N).Where the laws vary among various states, assume that the most common rules apply.All taxpayers are individuals.

Correct Answer:

Verified

Q113: In some states, an S corporation must

Q117: A _ tax is designed to complement

Q120: Typically, the state's payroll factor _ (does/does

Q121: Condor Corporation generated $450,000 of state taxable

Q123: A number of court cases in the

Q124: You are completing the State A income

Q127: Mercy Corporation, headquartered in F, sells wireless

Q128: Kim Corporation, a calendar year taxpayer, has

Q129: A state wants to increase its income

Q191: Your supervisor has shifted your responsibilities from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents