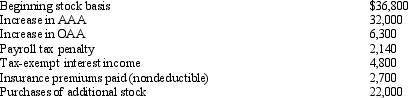

You are given the following facts about a 40% owner of an S corporation, and you are asked to prepare her ending stock basis.

A) $71,600.

B) $74,120.

C) $76,220.

D) $78,920.

Correct Answer:

Verified

Q64: Which, if any, of the following can

Q74: Which equity arrangement cannot be used by

Q83: Distributions of which assets during an S

Q87: On January 1, 2012, Zundel, Inc., an

Q88: On January 2, 2011, David loans his

Q93: On January 2, 2011, Tim loans his

Q95: A calendar year C corporation reports a

Q96: Ryan is the sole shareholder of Sweetwater

Q97: An S corporation reports a recognized built-in

Q98: Samantha owned 1,000 shares in Evita, Inc.,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents